August 12, 2015

Understand the balance

Part 1 of 2: Balance sheets are a ‘selfie’ of your business at a point in time; learn how to use them to advantage.

BY LEE ANN KNUDSENEditor’s note: Landscape Trades interviewed Nathan Helder about using Profit and Loss Statements to manage financials in January, 2014; read that story on landscapetrades.com/PandL. Helder, of Gelderman Landscape Services and Southbrook Consulting, Waterdown, Ont., continues the discussion on financial management.

Nathan Helder has a dream. He wants landscape business owners to move away from regarding their companies as everything: their ‘baby,’ their life, their retirement. Instead, companies should be a means to generate wealth and security for families — independent of the business.

The best financial tool to help understand and achieve that goal, according to Helder, is the Balance Sheet. But he says it is rare to find a landscape company owner that truly ‘gets’ this important piece of paper. “Many contractors look at the Retained Earnings line only; many don’t look at the balance sheet at all, because it scares them.”

The balance sheet is simply a current snapshot of your company’s finances. Unlike the Profit and Loss (Income) Statement, it shows how cash is (or is not) flowing through your business, your debt position and other indicators that have everything to do with your company’s health, as well as opportunities to make best use of your resources.

Says Helder, “Businesses don’t go bankrupt because they are not profitable, but because they run out of cash and can’t meet their financial obligations as they come due. You don’t see a business that is typically slow in sales go bankrupt, but one that is booming, having fun and growing too quickly.” He cautions that profitable, growing companies can run out of cash because they need increasing amounts of working capital to support equipment and labour investments.

How does the balance sheet work?

Every balance sheet has two parts. The first is Total Assets, the second is Total Liabilities and Owners Equity. The total dollar amount for the two sections is always identical.

Assets = Liabilities + Equity

- Assets: What a company owns or will receive: cash, accounts receivable, notes receivable, equipment, buildings, land, office equipment

- Liabilities: are what the company owes; lines of credit, accounts payable, the portion of long term debt that needs to be repaid within one year, accrued taxes etc.

- Equity: represents retained earnings and funds contributed by shareholders

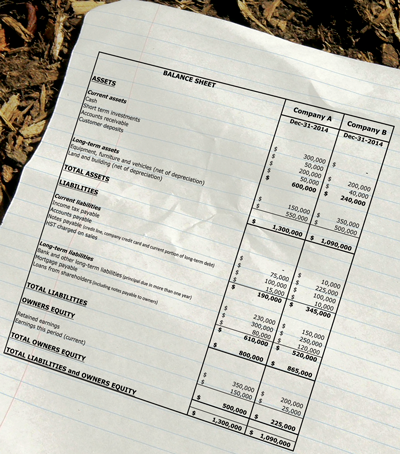

To illustrate that point, Helder created balance sheets for two fictional landscape companies shown above. He cautions that the companies are not “bad” and “good,” but rather each was created to show its own challenges — which the balance sheets reveal.

Looking back to grade school math, one might be challenged to find business owners who remember enjoying the study of ratios. However, ‘ratio’ simply means a relationship between numbers, and mining a few easy ratios from balance sheets unlocks hugely valuable insights on companies.

Can you pay your bills?

Nearly everyone in business understands, at some time or another, what it feels like to owe bills that can’t be paid. The Working Capital, or Current, Ratio expresses a company’s ability to pay bills with an exact number.

Working Capital, or Current, Ratio = Current Assets ÷ Current Liabilities

- Company A has $600,000 in assets divided by $190,000 in current liabilities, for a Working Capital Ratio of 3.16

- Company B has $240,000 in assets divided by $345,000 in current liabilities, for a Working Capital Ratio of 0.7

A number below 1.0 indicates negative working capital; as shown above, Company B owes more than it has. Trouble paying creditors over the short term could lead to the worst-case scenario of bankruptcy. Ratios between 1.2 and 2.5 indicate a good, healthy balance of utilizing current assets. A company with a ratio exceeding 2.5 has lots of flexibility to expand operations. However, sitting on excess inventory is not always good.

This ratio can also be misleading; if a company’s current assets are high due to large inventories or old accounts receivable due to poor collections, it can give a false sense of security. You may still be running out of cash.

Are you milking your business?

The Debt to Equity Ratio is important to bankers, as they want to ensure that you leave enough money in the business. If you pull cash out, and yet have high liabilities, your creditors may feel threatened and put more pressure on your business. A high Debt to Equity Ratio generally means that a company has been aggressive in financing its growth with debt, rather than using accumulated profit.

Debt to Equity = Total Liabilities ÷ Total Owners Equity

- Company A has $800,000 in liabilities divided by $500,000 in Owners Equity, for a Debt to Equity Ratio of 1.6

- Company B has $865,000 in liabilities divided by $225,000 in Owners Equity, for a Debt to Equity Ratio of 3.84

Nathan Helder is animated and convincing when he talks about how understanding numbers really gives a business owner control. He urges those feeling unsure about where to start to reach out for help. But he is much more than a numbers guy; he truly wants his fellow landscape industry members to follow his dream about using numbers to achieve larger goals. Says Helder, “This is all about making sure your family

is okay.”

Coming in August Landscape Trades: Nathan Helder explains how to further decode the Balance Sheet in Part 2 of this story. Quantify how much your company relies on debt, whether your equipment investments are effective and learn how to measure your company’s profitability compared to equity.